Increase to employers’ contributions, reduction of contribution weeks for the guaranteed pension and limitation to the management fees of pension fund managers.

On July 22, 2020, the Executive Branch announced the initiative proposal of amendment to the Social Security Law (“SSL”) and to the Retirement Savings Systems Law (“RSSL”), which, as informed, was discussed and agreed with the Business Coordinating Council and the Employees Confederation of Mexico (CTM).

In September 2020, the initiative was filed before the Legislative Chamber, and once the draft was discussed, the Congress approved the initiative for its enactment, which decree was published in the Official Gazette of the Federation on December 16 of this 2020.

This amendment’s purpose is to: (i) increase the contribution to the savings for the retirement of the employees for concept of old-age severance, being the employer who will assume such increase; (ii) modify the social fee granted by the Federal Government; (iii) reduce from 1,250 to 1,000 contribution weeks for the obtention of a guaranteed pension; (iv) modify the amount of the guaranteed pension; and (v) limit the management fees of the Pension Fund Managers(“AFORES” for its initials in Spanish).”).

(i) Increase to the Employers’ Contribution

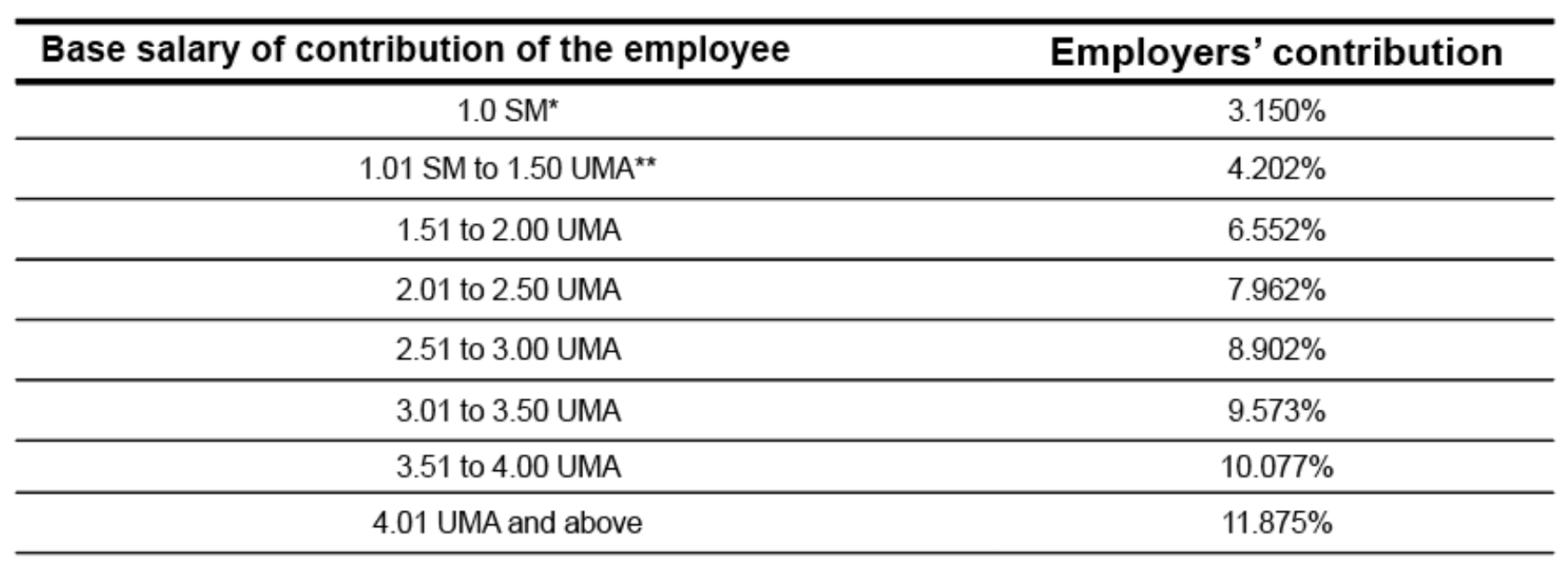

Before this amendment, employers were obliged to contribute (i) for concept of retirement, the equivalent amount to 2% of the base salary of contribution of the employee, and (ii) for concept of old-age severance, 3.150% of the base salary of contribution.

As of the date in which the amendment will enter into force, the employers will temporarily continue to contribute for concept of retirement 2% of the base salary of contribution of the employee and shall increase the contributions for concept of old-age severance, from 3.150% to 11.875%.

The percentage of this contribution will depend on each employee’s income, from 3.150% of base salary of contribution for the employees with an income of 1 Minimum Wage(for its initials in Spanish, “SM”)until 11.875% of the base salary of contribution for employees with income of 4.01 Updating Measurement Units(for its initials in Spanish, “UMAs”)and forward, as described below:

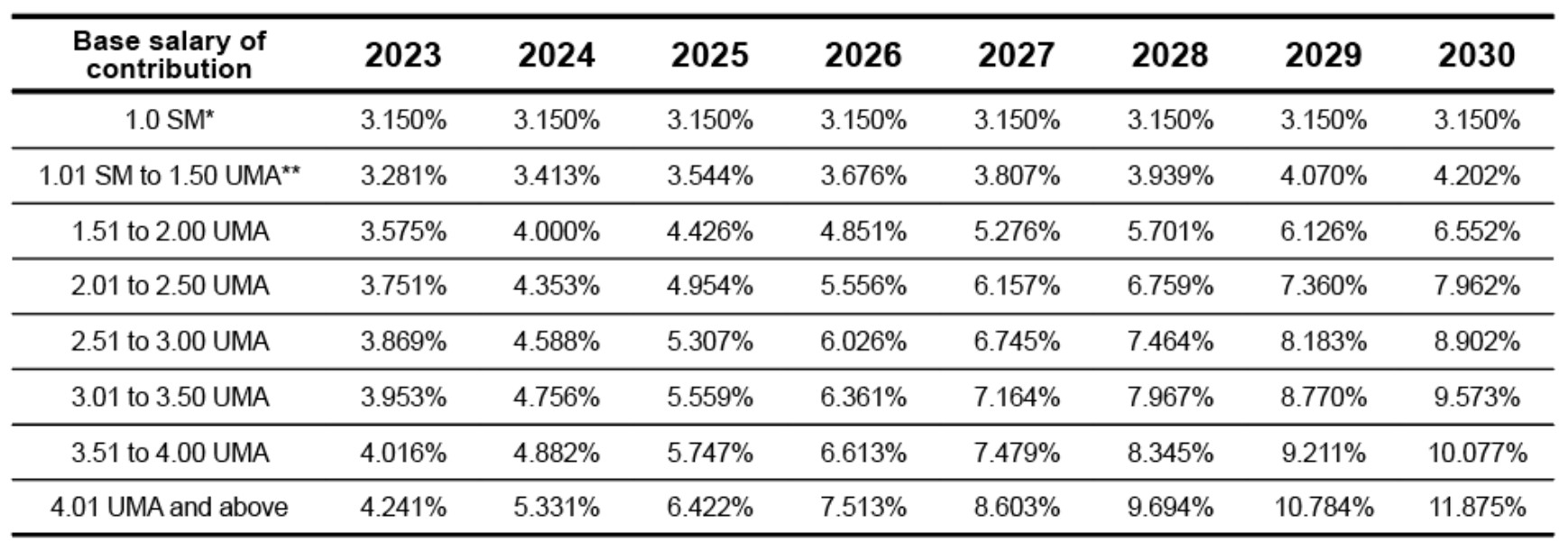

The increase to the employer’s contribution will not be directly effective as of the date the amendment enters into force. In the transitional articles thereof is foreseen a progressive application in time, gradually as of January 1, 2023 until year 2030, in accordance with the following table:

(ii) Government Contributions and Social Fees

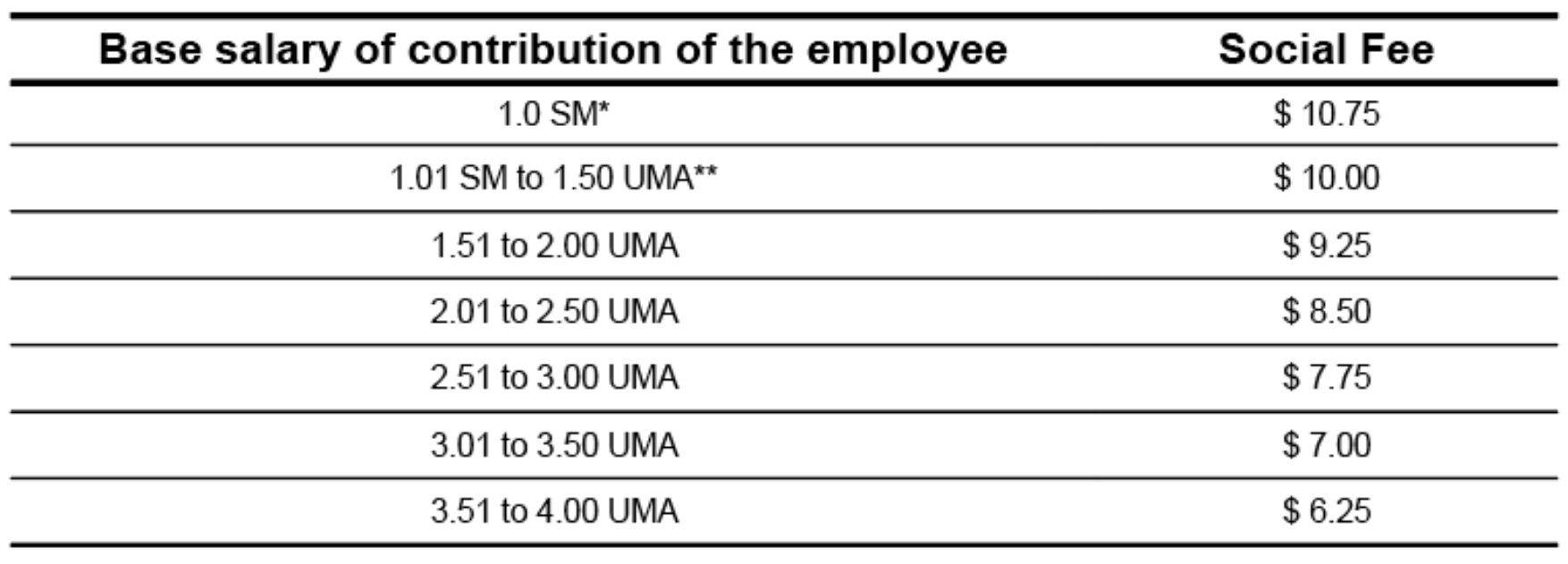

In accordance with the approved amendment, the Government contribution of 7.143% of the total of the employers’ contributions for concept of old-age severance is eliminated and the way to calculate the amount of the social fee in charge of the Federal Government is modified.

Previously, the Federal Government granted on a monthly basis, to such employees that earn until fifteen time the minimum wage in force in Mexico City, a social fee for an initial amount equivalent to 5.5% of the minimum general wage of Mexico City, for each day of contribution wage of the employee.

As of January 1, 2023, the amount of employees with access to such fee is reduced, and the way to calculate such amount is modified. In the new legal framework, the Federal Government will monthly contribute, to the employees that have income until four UMAs, a social fee from $10.75 Mex.Cy. for the employees with a base salary of contribution of 1 Minimum Wage and until $6.25 Mex.Cy. for such employees with a base salary of contribution of 3.51 to 4 UMAs. These amounts will be modified quarterly in accordance with the National Consumer Price Index(for its initials in Spanish, “INPC”).”).

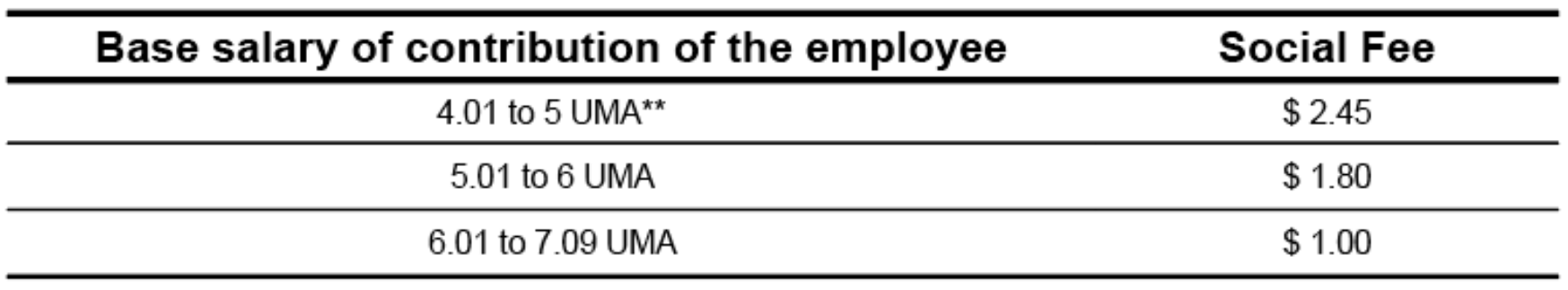

The provisions related to the social fee hereinbefore described will enter into force as of January 1, 2023. Notwithstanding the foregoing, from January 1 to December 31, 2023, the Federal Government for concept of old-age severance, will monthly contribute an amount for each day of salary of contribution, as social fee for the employees that have income from 4.01 to 7.09 UMAs, in accordance with the following table:

(iii) Guaranteed Pensions

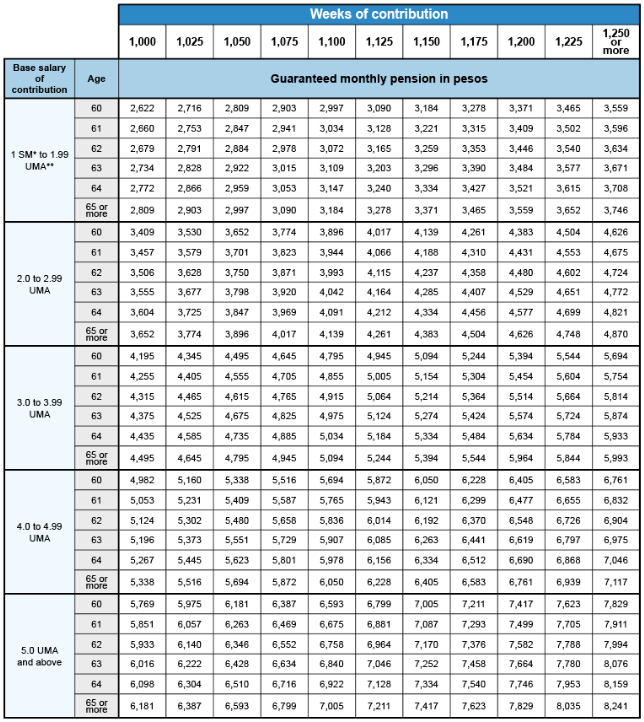

Regarding the guaranteed pensions, the provisions are modified with the principal purpose to allow a greater number of employees to have access to such pensions, in view that the contribution weeks are reduced from 1,250 to 1,000 to be entitled to receive such pension. Furthermore, the amount of the guaranteed pension is modified and will be calculated based on: (i) age, (ii) average of the base salary of contribution during the affiliation of the employee in the Mexican Institute of Social Security(for its initials in Spanish, “IMSS”), and (iii) the contribution weeks of the employee. Such guaranteed pension will be from $2,622 Mex.Cy. until $8,241 Mex.Cy., amounts that will be updated annually on February in accordance with the INPC. The calculation will be carried out based on the following table:

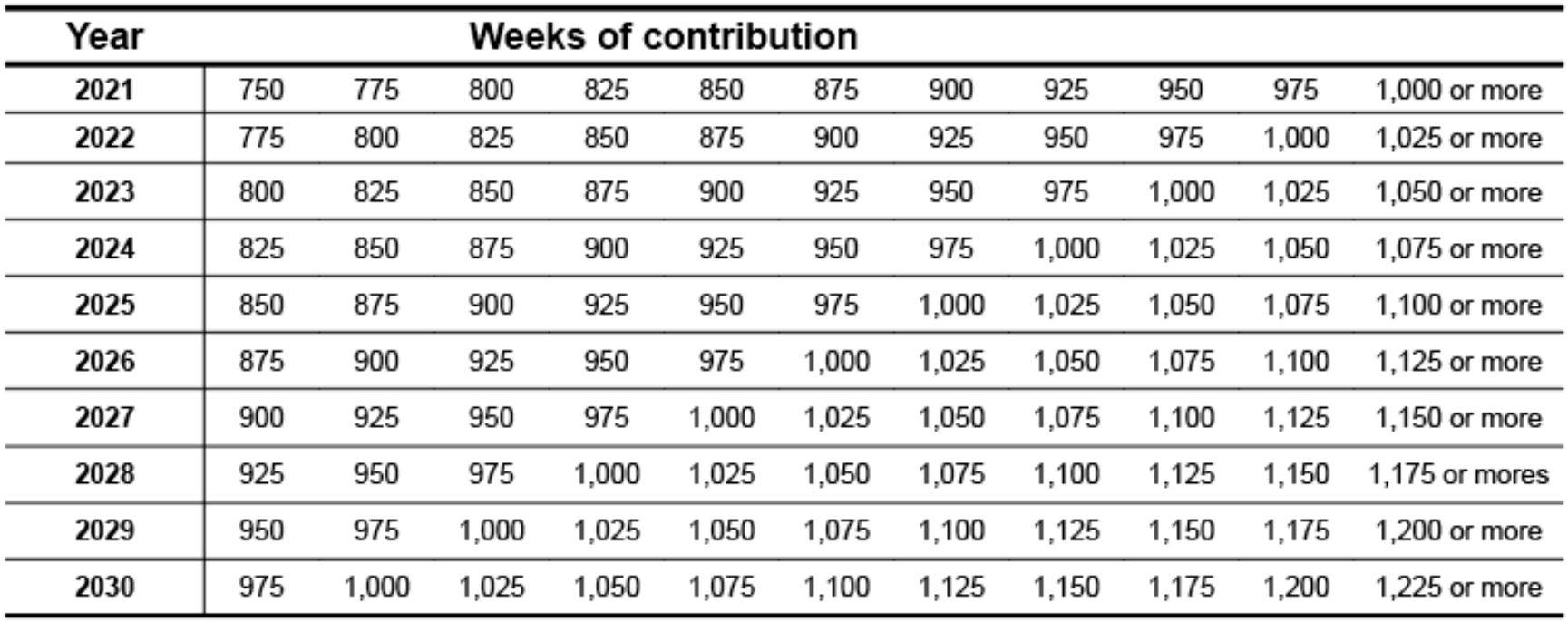

As of the date in which the reform will enter into force, 750 contribution weeks will be the minimum to be entitled to obtain the guaranteed pensions, and 25 weeks will be annually increased until achieving those set forth in the amendment, in accordance with the following table:

(iv) Limitation to Management Fees of the AFORES

In addition to the foregoing, the AFORES management fees are limited based on the international standards of the United States of America, Columbia and Chile, and in accordance with the policies and criteria to be issued by the Government Board of the National Commission of the Savings Fund for Retirement in such regard. This Commission will have a term of 30 business days as of this amendment, to modify the general provisions in order to comply with this new provision.

(v) Relevant Provisions and Conclusion

Finally, pursuant to the new legal framework, authority is granted to the IMSS to dispose of the resources contributed as of 10 years as of its enforceability, without judicial resolution needed, provided that constitutes a sufficient reserve to attend refund applications to employees, pensioners or beneficiaries. We consider that this authority granted to the IMSS breaches rights, having considered that the pension rights are imprescriptible.

The modification to the financial regime of old-age severance impose additional economic burdens to the employers, that we estimate shall be absorbed and assumed as part of the compensation load that from time to time will be negotiated with the employees and/or unions. Doubtlessly, this represents an improvement to the retirement system in attention to the demographic curves of the economically active population, considering that the positive curve finalizes in 2030 and, therefore, after such breaking point, the possibility to fund the pensioners by the active employees will no longer be viable.