Los invitamos a leer nuestra participación en la revista Industria Legal, donde nuestro socio Emilio Garzón redactó el articulo “Reforma a la subcontratación laboral ¿Es un cambio positivo?”. Siendo los representantes en derecho laboral, agradecemos el esfuerzo de nuestros abogados y la invitación por parte de la revista.

Continue readingJorge Castro Duplan

Jorge Castro is a Senior Associate at Marván, González Graf y González Larrazolo, where he focuses on the labor, constitutional tax and administrative litigation practice areas.

Mr. Castro has more than six years of experience in Labor Law, five years in Tax and Administrative Law, and two years in Civil Law. Within the firm, he works as an analyst and consultant for clients in the financial sector, construction and other services, both domestic and foreign, with subsidiaries in several countries. Likewise, he supports with recommendations and consultations regarding the best functioning of labor relations in the administrative, operative, economic, political and legal areas of the companies. In addition, he assists in the management and negotiation of collective relations with companies.

Throughout his career, Mr. Castro has participated in the advice and transfer of companies with more than one thousand workers. He has also collaborated in the opinion of regulations and parliamentary practices of the Senate and in the election of INAI's commissioners.

Antes de unirse al equipo de Marván, González Graf y González Larrazolo en 2014, Jorge Castro trabajó en diversas áreas de Gobierno como litigante en materia fiscal y administrativa, en la Procuraduría Fiscal de a Federación, el Senado de la República, el Instituto Federal de Acceso a la Información y Protección de Datos (IFAI) y el Tribunal Federal de Justicia Fiscal y Administración.

Josué Medel Portillo

MGGL, RECONOCIDA COMO FlRMA ESPECIALIZADA EN LITIGIO Y ASESORÍA LABORAL EMPRESARIAL”

For more than 70 years, Marván, González Graf y González Larrazolo (MGGL) has defended the principles of justice and equity. The congruence with which they work, both internally and with their clients, has been a factor of development and consistency in their professional practice.

"We are convinced that strict compliance with the law and our principles give us the best platform for attracting, developing and retaining talent," say the firm's partners.

In the face of a new Public Policy scenario, MGGL , a firm specialized in Litigation and Business Labor Counseling, is confident that the administration of justice and the level of compliance with the rules applicable to employers, unions and workers in our country will improve.

In this sense, Mexico must move towards a wage model based on productive capacity and efficiency. The scenarios demand that the business, labor and government sectors coordinate and align to achieve synergies and find objectives that mean mutual benefits. Only in this way will there be an improvement in the skills and capabilities in the work of employees and productivity in companies, so as to increase margins, income levels and the standard of living of employees.

According to Dr. Héctor González Graf, with the entry into force of the T-MEC, Mexico's trade partners, who consider Mexico's wage policy in recent years as an unfair trade strategy from their perspective, are guaranteed to strictly follow Mexico's labor standards.

"The T-MEC labor regulation aims for companies with Collective Bargaining Agreements to have a union that is truly representative of the workers, which encourages the establishment of better wages and working conditions."

In view of these needs, MGGL agrees to generate models that ensure compliance with labor and social security rights, without losing competitiveness. MGGL is a Firm that grows year after year and is currently ready to help all its clients to meet and solve the challenges that the judicial transition and the new model of collective relations will bring.

"We will continue to build with a long-term vision. Our institutional vision and work team of 120 people allows us to address issues of any scale at a national level, concludes Dr. González Graf.

The original text appeared first in Tops Los Mejores Abogados. You can read the original publication here.

Oscar Bojorge

Oscar Bojorge es socio en Marván, González Graf y González Larrazolo, donde se enfoca en litigio y asesoría laboral.

Mr. Bojorge joined the firm's team more than seven years ago, and in his practice he accompanies the firm's clients in the implementation of labor relations management strategies. Likewise, he has actively participated in the training programs implemented by the Firm, putting into practice his vocation for learning and constant updating in labor matters.

Héctor González Graf

Héctor González Graf is a founding partner of Marván, González Graf y González Larrazolo, a leading Labour & Employment law firm in Mexico with offices in Mexico City, Guadalajara and Michoacán. His practice focuses on the labour aspects of high-end M&A deals and corporate restructurings, and high stakes labour disputes.

His clients include leading national and multinational companies and financial institutions with extensive operations in Mexico, and his team often works alongside international and leading national law firms on major business transactions in Mexico. He is head counsel for 100+ clients of the firm, and has a wealth of experience on the employment law issues that arise from multinational companies acquiring employee-heavy businesses in Mexico, particularly in the insurance, financial services, retail and consumer goods sectors.

Santiago Marván Urquiza

Santiago Marván is a senior partner of Marván, González Graf y González Larrazolo, a leading Labour & Employment law firm in Mexico with offices in Mexico City, Guadalajara and Michoacán. His practice focuses both on transactional work, labour consulting and dispute resolution. He is lead counsel for blue-chip corporate clients and prominent financial institutions. He is also a preferred partner for market-leading corporate law firms in Mexico City, whom he frequently advises on the labour aspects of high-end M&A and corporate restructurings.

Mr. Marván has over 30 years of experience advising companies on their most complex and challenging labour law issues, particularly in the financial services, industrial manufacturing, retail and consumer goods sectors.

SENADO APRUEBA REFORMA A LEYES DEL TRABAJO Y DEL SEGURO SOCIAL EN MATERIA DE SUBCONTRATACIÓN

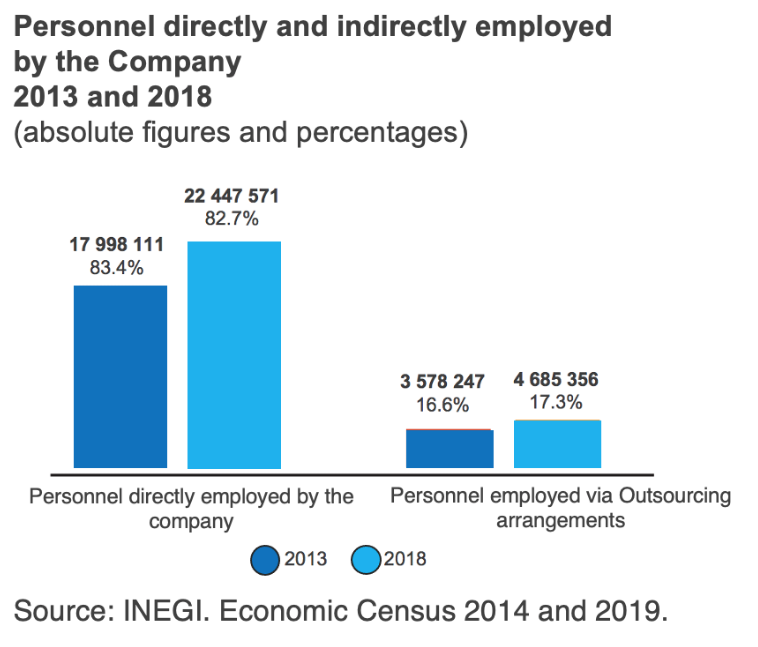

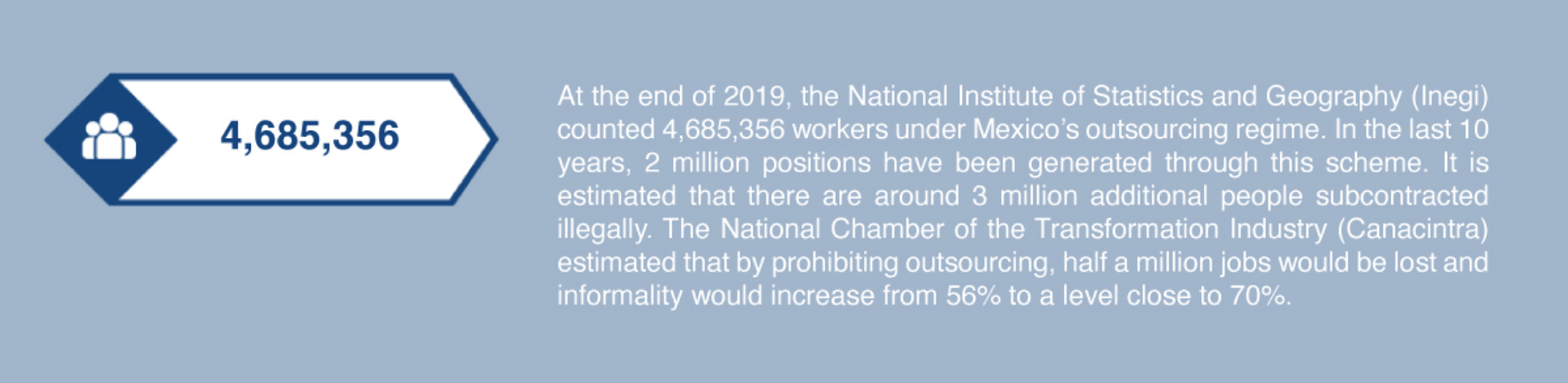

As consequence of the approval of the Decree which amends, adds and derogates those provisions of the Federal Labor Law, Social Security Law and other regulations, in regard to subcontracting (outsourcing) and profit-sharing, the established models for contracting have been modified, thus impacting all employment levels, employee compensation and, in general, the outsourcing industry.subcontracting.) y reparto de utilidades, se modifican modelos establecidos de contratación que afectarán los niveles de empleo, la compensación de los trabajadores y en general la industria del subcontracting..

Content of the Amendment

The approved text prohibits subcontracting of personnel, considering such term as the assignment of employees to a beneficiary of the service. Historically, this subcontracting scheme has been carried out by (a) companies which hire personnel to be assigned to carry out inherent activities of the services beneficiarysubcontracting.and (b) between companies of the same corporate groupinsourcing).

Regardless the general prohibition of outsourcing, the amendment allows outsourcing, provided that the following conditions are complied: (i) the provision of specialized services or the execution of specialized works that are not included in the corporate purpose nor in the core business activity of the beneficiary; and (ii) that the subcontracting company that will be rendering the specialized services is duly registered before the public registry created for such purposes by the Ministry of Employment and Social Welfare –registry that will be effective for a term of three years–.

The second exception to the prohibition of subcontracting of personnel allows complementary or shared services to be rendered between companies of the same corporate group.

The text of the amendment is not precise in the definition of the abovementioned concepts, so we consider that they should be construed as follows:

- Specialized services are those unrelated to the corporate purpose or core activity that justify hiring a third party. Furthermore, from our perspective, those complementary services that provide aggregate value or technical knowledge, may be deemed as specialized.

- For better understanding of the scope of the activities that may be considered as core activity or business, article 45 of the Federal Tax Code Regulations establishes that the business activity for which the greater income is obtained, with respect to any other activity, is considered as the main or core business.

- Regarding the obligation to be registered before the Ministry of Employment and Social Welfare, we estimate it will apply exclusively to those subcontracting companies that offer specialized subcontracting services. Therefore, it would not be applicable to services rendered between companies of the same corporate group. The argument is based on , the express differentiation for this type of services, referring to them as “complementary or shared services”, equating them to a specialized service, but without binding them expressly to the subcontracting regime.

For compliance purposes, the companies, within the following three months as of the effective date of the amendment, may carry out a “special employer substitution”, without transfer of goods, for social security purposes, provided that all acquired labor rights are recognized. We estimate that such mechanism should be analyzed prior to its implementation, since it may result risky for the companies that will undertake as their own the personnel through the employer substitution, since those companies would acquire, in addition to the labor obligations, the social security obligations of the transferred personnel for the last five years.

Additional Provisions

The companies that execute outsourcing agreements in the terms referred hereinbefore, will be jointly responsible of the social security obligations with respect to the employees hired for the rendering of services, in the event the subcontractor breaches any of such obligations. Likewise, the companies that provide subcontracting services shall report quarterly to the Mexican Institute of Social Security (“IMSS”, for its initials in Spanish), in addition to the information that currently should be reported, (i) a list of the employees subject to enrollment; (ii) Unique Population Registry Key (“CURP”, for its initials in Spanish); (iii) social security number; (iv) contribution base salary; (v) federal taxpayer registry (“RFC”, for its initials in Spanish); and (vi) copy of the registry before the public outsourcing registry.

Subcontracting services shall also be reported quarterly before the Workers' National Housing Fund Institute (“INFONAVIT”, for its initials in Spanish), considering the above-mentioned information, as well as the amounts of the contributions and amortizations before said Institute.

Profit Sharing

The prohibition to outsource personnel implies that the companies shall hire their employees directly, being obliged to share profits with them. The Decree contains a modification to the model of profit sharing, establishing as a maximum limit for the payment of profit sharing to the employees, the amount of three months of salary or the average of the profit sharing amount received by them during the last three years, whichever results the most beneficial for the employee.

The fact that a maximum limit is established for the payment of profit sharing does not modify the proceeding for its determination, nor the limits referred in section II of article 127 of the Federal Labor Law that establish as a maximum salary cap for employees of trust, the salary of the unionized employee or higher equivalent increased by 20%, so, in all events, the daily base salary will be taken into account for the determination and calculation of the amount to share.

Fines and Penalties

In order to ensure the compliance of the measures established in connection with outsourcing, fines are set forth for those who breach the content of the amended provisions. Those fines will range from 2,000 to 50,000 Measure and Update Units (“UMA”, for its initials in Spanish) (each UMA is currently equivalent to $89.62 Mex.Cy.) The fines would be applied to both the beneficiary and subcontractor.

With regard to the foregoing, in accordance with article 992 of the Federal Labor Law, when one sole act or omission affects several employees, a penalty will be imposed for each of the affected employees, so such penalties may be calculated based on the number of employees under the subcontracting regime multiplied for the value of the imposed penalty for each one of them, which may result in costly penalties.

Aside from the applicable fines, the Federal Tax Code has been amended, among other laws and regulations. Specifically, article 15-D of such Code establishes that the payments or compensations carried out under subcontracting of personnel to perform activities related to the corporate purpose and core business activity of the contracting party, will not be deductible nor credited.

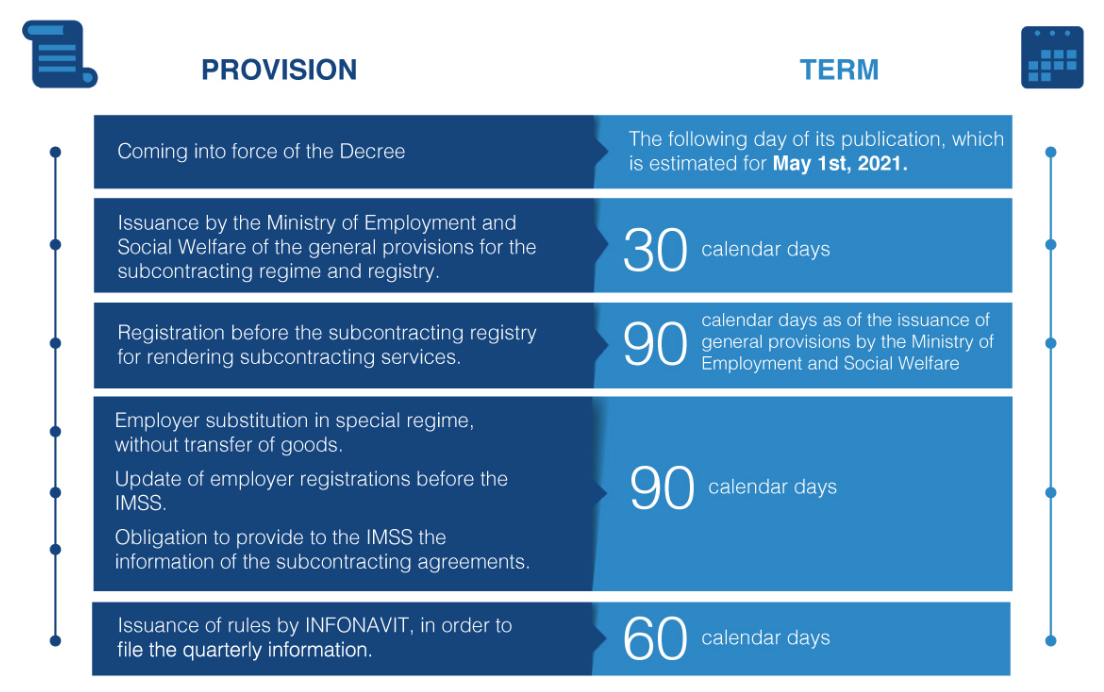

Terms for Compliance

The transitory articles of the amendment foresee the following terms:

Rendering of Independent Services

The Decree does not compromise the possibility to hire services under a scheme of independent services. The derogation of Article 13 of the Federal Labor Law does not impede the execution of services agreements between independent companies. The hiring of independent services shall not imply the assignation of personnel, nor authorize the beneficiary of the services to control, direct and supervise the employees or individuals that render the services. It is important that the services under this scheme are carried out with the provider’s own material resources, which, with material and human solvency, provides the services in accordance with the standards and levels of service in the corresponding industry.

In view of the foregoing, and except the Ministry of Employment states otherwise, the companies will be responsible to identify if it is necessary to carry out the registration to perform their activities. In the last scenario described, no scheme of outsourcing of personnel is constituted, and therefore, there would not exist any obligation to carry out the enrollment before the implemented registry for such purposes.

LA EVOLUCIÓN DE LA LEY DEL TELETRABAJO EN MÉXICO

An overview of the legal framework applicable to telework and remote working in Mexico, and what this could mean for employees and employers alike.

Since 2019, Mexico’s Congress has been working on an amendment to the legal framework applicable to teleworking and remote working. On 8 December 2020, the legislative chamber discussed and approved the draft of an amendment to article 311 of the Federal Labor Law (FLL) and the addition of Chapter XII BIS. These new provisions became mandatory on 12 January 2021 during the labour emergency declared due to the covid-19 pandemic, a time in which most, if not all the companies had established home office programs to prevent contagion. The integration of “home office” into the FLL in 2012 was incorrect and incomplete, however. Through a technical mistake, teleworking was equated with home working. In the new legislation, the distinction between these concepts is that home office is work carried out at the domicile of the employee, without being under the control and direction of the employer. Teleworking, by contrast, applies under the following conditions: that the work is rendered in a different place to the workplace of the employer; that it is not required for the employee to be in the employers’ facilities; and that technology is used for the administration of the labour relationship and supervision of the performed service. Before the amendment came into force, we identified at least three relevant forms of work concerning the rendering of services under the home office scheme or remote working. These forms of services are rendered through information technology and have been established in general under the labour rights and obligations of the FLL, in agreements whereby the parties set forth the terms and conditions of the service. First, for convenience and efficiency, employees have their employer’s authorisation to work, in extraordinary circumstances, one or two days per week remotely, performing their services by technological means, but, because of their roles, they must render their services in the employers’ facilities in normal circumstances. Second, employees that may render their services remotely or in their employers’ facilities and, due to the nature of their role, have the freedom to determine where they perform their duties. Finally, employees that render their services in their home, or a place freely chosen by them, and who will be subject to the new legal framework. Pursuant to the new regulations, these workers must meet additional requisites to be considered as teleworkers: (i) their services are not necessary in the employer’s facilities; (ii) they render their services constantly out of the employer’s premises, and fulfil more than 40% of their work away from the office. As a special work regime, an agreement must be entered into between the employer and the teleworker, in which the obligations, rights, and responsibilities of a labour relationship under such conditions are established, including equality in the treatment to teleworkers and employees. Among others, it shall contain: a description of the equipment and work supplies; contact and supervision mechanisms between the parties; working hours, including connection and disconnection periods; the employer’s and teleworker’s compliance with obligations and responsibilities in matters of health, security, and workplace welfare; how the modality of teleworking may be revoked according to the existent labour relationship; the collective bargaining agreements and internal work regulations, which must include the terms and conditions of teleworking, providing a communication system for employees; and employers must provide supplies and equipment, and pay the proportional costs of connectivity and electric energy services. The law expressly refers to computer equipment, ergonomic chairs and printers, among others. The amendment foresees the creation of a Mexican official standard in health, security, and workplace welfare, for activities outside the workplace using information and communication technologies within the next 18 months. In the same manner, the amendment establishes that the authorities will integrate a national network of advice regarding, and promotion and development of, teleworking referred to in the draft of the amendment, as well as establishing guidelines related to accidents and illness while teleworking. In general terms, we anticipate that the amendment will contribute to the security of labour relationships that are performed under these conditions. Companies will be able to guarantee the efficiency and quality of services rendered through remote or teleworking. Under the special obligations and rights, we predict additional conditions in labour agreements between employer and employee to include: an obligation to perform the services using a tool, such as a laptop, assigned by the company; an obligation to maintain the equipment for the performance of the entrusted activities (hardware as well as software); an employee must comply with all the obligations, work, activities, and projects that must be carried out physically in work facilities or other places; limits to working hours, availability of schedule, supervision, digital connectivity, and disconnection; the company reserves the authority to determine the activities, deadlines, works, projects, and tasks carried out by the employee, indicating the necessary requirements and specifications; the mode of remote or home working may be modified, suspended, or cancelled, in certain circumstances when the company considers it necessary, provided that the employee’s rights are not affected; protection of personal data and privacy of the employee; and the maintenance of the company’s confidential information. It is important to differentiate the telework regime from the pandemic home office prevention programme. Agreeing to the provision of services from home does not imply that services are unnecessary in the company’s facilities, and does not transform the employees’ status to teleworkers. Once the health emergency has concluded, employees shall once again provide their services in the workplace as they did before the covid-19 pandemic. Employers need to review the terms and conditions of their labour agreements to verify that the cause of modification to the labour relationship was caused by the health emergency, and that the company has full authority to terminate the agreement so employees can return to the workplace. This article was first published at here.

SOCIO HÉCTOR GONZÁLES GRAF SE INTEGRA AL CONSEJO EDITORIAL DE INTERNATIONAL EMPLOYMENT LAWYER

We are very proud to have our founding partner, Héctor González Graf, join as a key player in this innovative project in the world of employment law. Together with 17 other renowned lawyers from all corners of the world, from Argentina to New York, the Netherlands, Hong Kong and Nigeria, International Employment Lawyer's mission is to provide information, data and analysis regarding the management of international workforces.

Dr. González Graf has contributed with his article "Mexico’s evolving teleworking law", where he explores the legal framework applicable to telework and remote working in Mexico, and what this could mean for employees and employers alike.