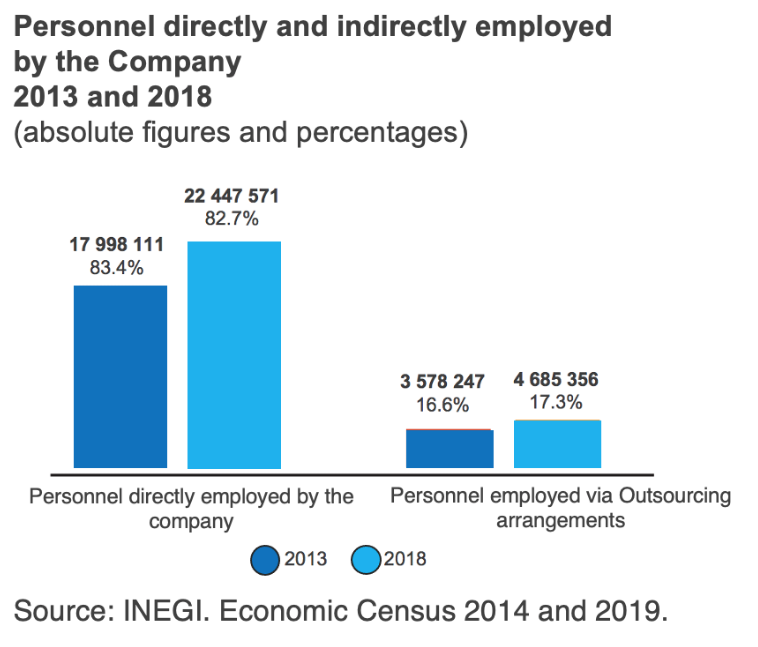

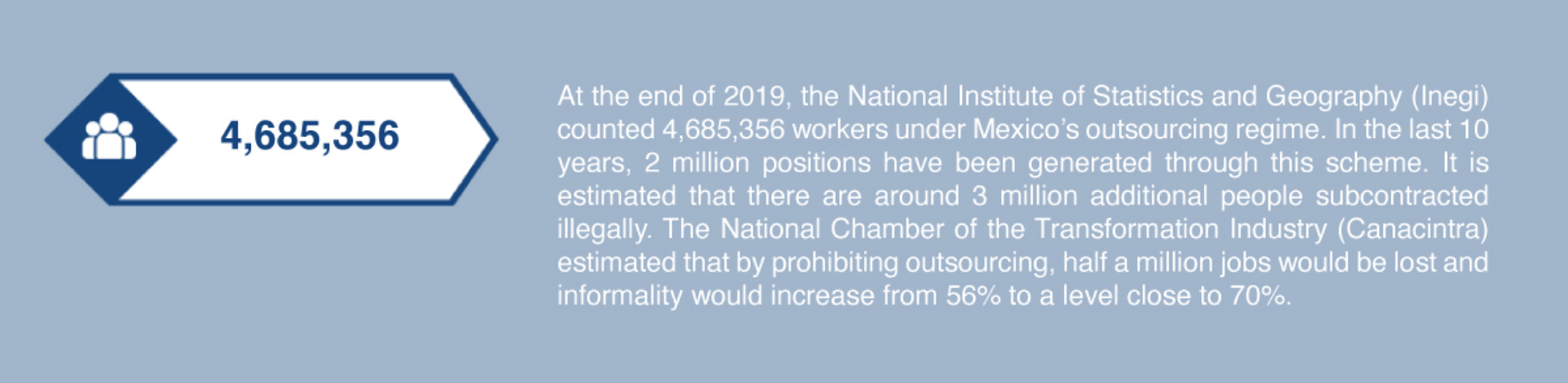

As consequence of the approval of the Decree which amends, adds and derogates those provisions of the Federal Labor Law, Social Security Law and other regulations, in regard to subcontracting (outsourcing) and profit-sharing, the established models for contracting have been modified, thus impacting all employment levels, employee compensation and, in general, the outsourcing industry.subcontracting.) y reparto de utilidades, se modifican modelos establecidos de contratación que afectarán los niveles de empleo, la compensación de los trabajadores y en general la industria del subcontracting..

Content of the Amendment

The approved text prohibits subcontracting of personnel, considering such term as the assignment of employees to a beneficiary of the service. Historically, this subcontracting scheme has been carried out by (a) companies which hire personnel to be assigned to carry out inherent activities of the services beneficiarysubcontracting.and (b) between companies of the same corporate groupinsourcing).

Regardless the general prohibition of outsourcing, the amendment allows outsourcing, provided that the following conditions are complied: (i) the provision of specialized services or the execution of specialized works that are not included in the corporate purpose nor in the core business activity of the beneficiary; and (ii) that the subcontracting company that will be rendering the specialized services is duly registered before the public registry created for such purposes by the Ministry of Employment and Social Welfare –registry that will be effective for a term of three years–.

The second exception to the prohibition of subcontracting of personnel allows complementary or shared services to be rendered between companies of the same corporate group.

The text of the amendment is not precise in the definition of the abovementioned concepts, so we consider that they should be construed as follows:

- Specialized services are those unrelated to the corporate purpose or core activity that justify hiring a third party. Furthermore, from our perspective, those complementary services that provide aggregate value or technical knowledge, may be deemed as specialized.

- For better understanding of the scope of the activities that may be considered as core activity or business, article 45 of the Federal Tax Code Regulations establishes that the business activity for which the greater income is obtained, with respect to any other activity, is considered as the main or core business.

- Regarding the obligation to be registered before the Ministry of Employment and Social Welfare, we estimate it will apply exclusively to those subcontracting companies that offer specialized subcontracting services. Therefore, it would not be applicable to services rendered between companies of the same corporate group. The argument is based on , the express differentiation for this type of services, referring to them as “complementary or shared services”, equating them to a specialized service, but without binding them expressly to the subcontracting regime.

For compliance purposes, the companies, within the following three months as of the effective date of the amendment, may carry out a “special employer substitution”, without transfer of goods, for social security purposes, provided that all acquired labor rights are recognized. We estimate that such mechanism should be analyzed prior to its implementation, since it may result risky for the companies that will undertake as their own the personnel through the employer substitution, since those companies would acquire, in addition to the labor obligations, the social security obligations of the transferred personnel for the last five years.

Additional Provisions

The companies that execute outsourcing agreements in the terms referred hereinbefore, will be jointly responsible of the social security obligations with respect to the employees hired for the rendering of services, in the event the subcontractor breaches any of such obligations. Likewise, the companies that provide subcontracting services shall report quarterly to the Mexican Institute of Social Security (“IMSS”, for its initials in Spanish), in addition to the information that currently should be reported, (i) a list of the employees subject to enrollment; (ii) Unique Population Registry Key (“CURP”, for its initials in Spanish); (iii) social security number; (iv) contribution base salary; (v) federal taxpayer registry (“RFC”, for its initials in Spanish); and (vi) copy of the registry before the public outsourcing registry.

Subcontracting services shall also be reported quarterly before the Workers' National Housing Fund Institute (“INFONAVIT”, for its initials in Spanish), considering the above-mentioned information, as well as the amounts of the contributions and amortizations before said Institute.

Profit Sharing

The prohibition to outsource personnel implies that the companies shall hire their employees directly, being obliged to share profits with them. The Decree contains a modification to the model of profit sharing, establishing as a maximum limit for the payment of profit sharing to the employees, the amount of three months of salary or the average of the profit sharing amount received by them during the last three years, whichever results the most beneficial for the employee.

The fact that a maximum limit is established for the payment of profit sharing does not modify the proceeding for its determination, nor the limits referred in section II of article 127 of the Federal Labor Law that establish as a maximum salary cap for employees of trust, the salary of the unionized employee or higher equivalent increased by 20%, so, in all events, the daily base salary will be taken into account for the determination and calculation of the amount to share.

Fines and Penalties

In order to ensure the compliance of the measures established in connection with outsourcing, fines are set forth for those who breach the content of the amended provisions. Those fines will range from 2,000 to 50,000 Measure and Update Units (“UMA”, for its initials in Spanish) (each UMA is currently equivalent to $89.62 Mex.Cy.) The fines would be applied to both the beneficiary and subcontractor.

With regard to the foregoing, in accordance with article 992 of the Federal Labor Law, when one sole act or omission affects several employees, a penalty will be imposed for each of the affected employees, so such penalties may be calculated based on the number of employees under the subcontracting regime multiplied for the value of the imposed penalty for each one of them, which may result in costly penalties.

Aside from the applicable fines, the Federal Tax Code has been amended, among other laws and regulations. Specifically, article 15-D of such Code establishes that the payments or compensations carried out under subcontracting of personnel to perform activities related to the corporate purpose and core business activity of the contracting party, will not be deductible nor credited.

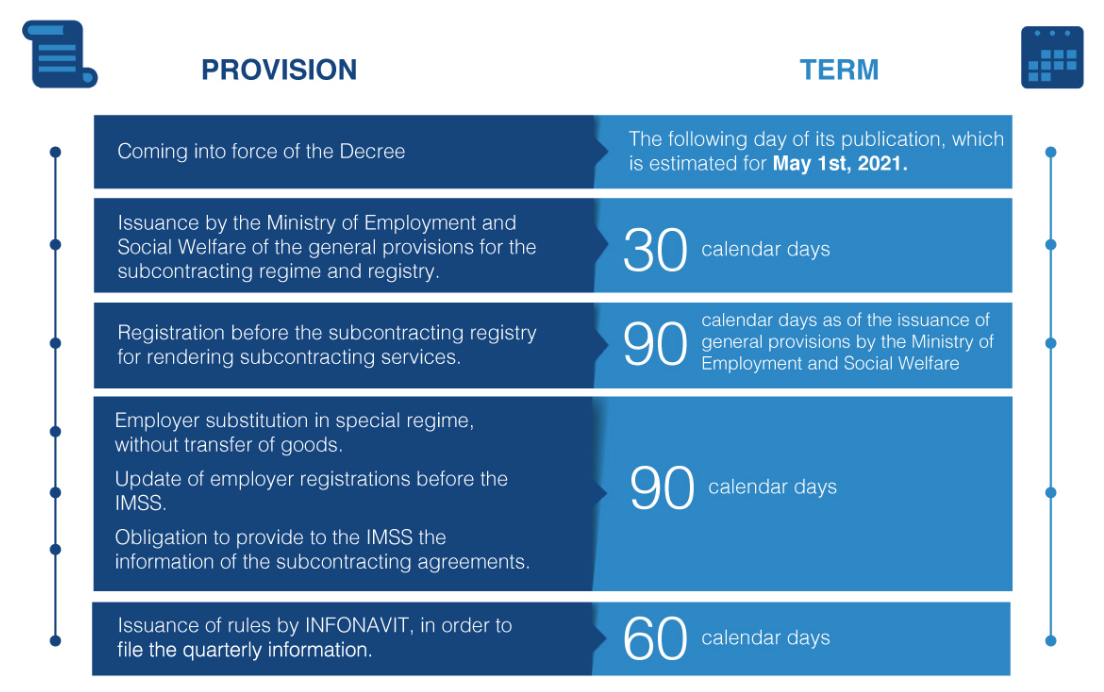

Terms for Compliance

The transitory articles of the amendment foresee the following terms:

Rendering of Independent Services

The Decree does not compromise the possibility to hire services under a scheme of independent services. The derogation of Article 13 of the Federal Labor Law does not impede the execution of services agreements between independent companies. The hiring of independent services shall not imply the assignation of personnel, nor authorize the beneficiary of the services to control, direct and supervise the employees or individuals that render the services. It is important that the services under this scheme are carried out with the provider’s own material resources, which, with material and human solvency, provides the services in accordance with the standards and levels of service in the corresponding industry.

In view of the foregoing, and except the Ministry of Employment states otherwise, the companies will be responsible to identify if it is necessary to carry out the registration to perform their activities. In the last scenario described, no scheme of outsourcing of personnel is constituted, and therefore, there would not exist any obligation to carry out the enrollment before the implemented registry for such purposes.